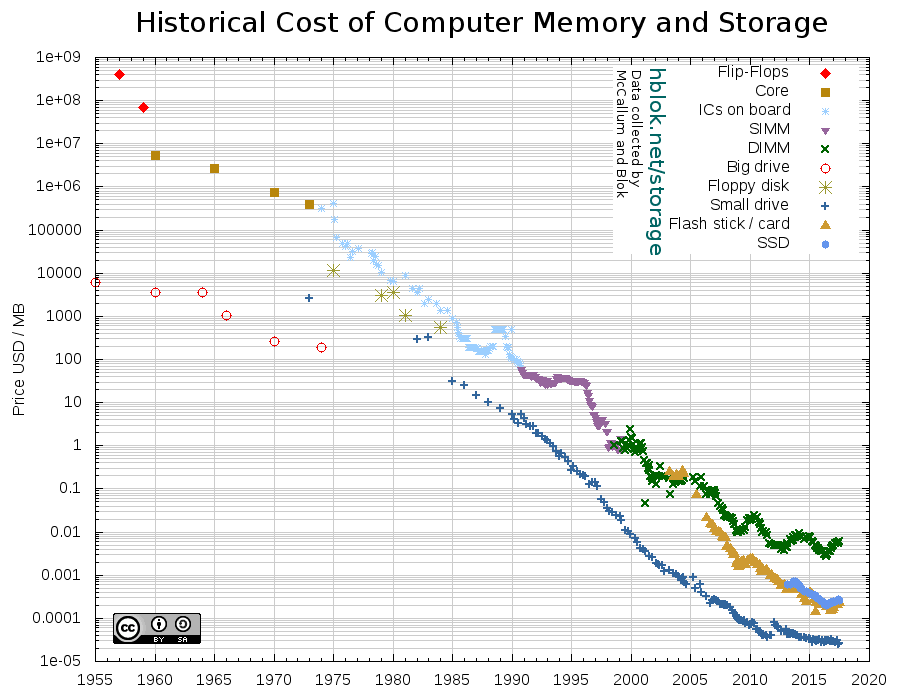

Historical Cost of Computer Memory and Storage

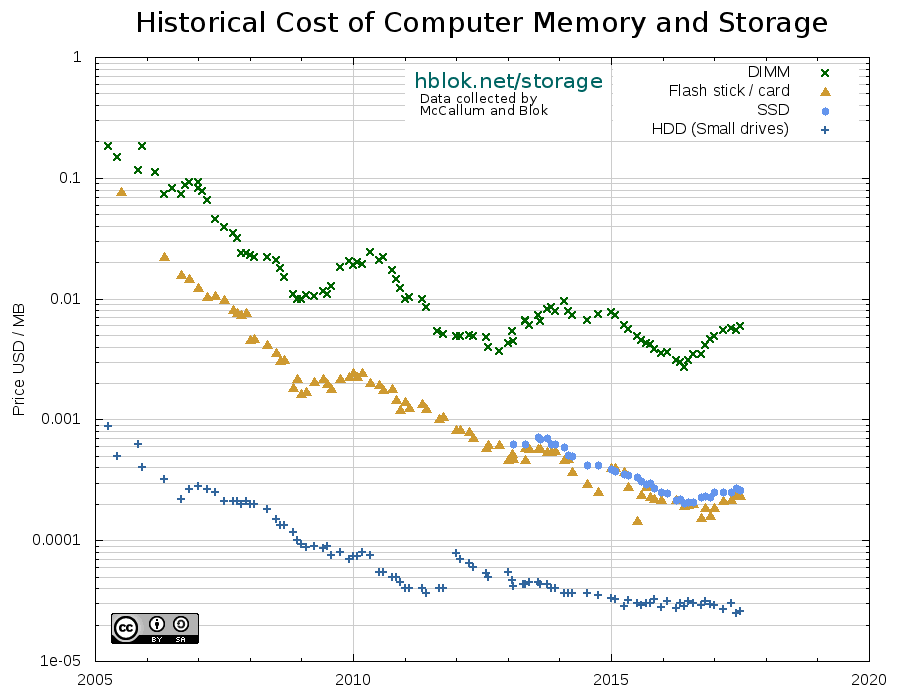

Following up on the last post, here is the long view of cost of computer storage. In the categories magnetic disks; RAM; and flash / SSD, it plots the cheapest USD-per-byte option over time. It confirms the stagnation of price improvements previously discussed. RAM is going through its cyclic volatility, and is now at a local peak (due to supply shortage; see below), while prices for magnetic drives are flatting out. Finally, SSD have gotten more expensive over the last year, also due to supply issue. Crossing the HDD trajectory is far of, and according to Western Digital's projections in the chart below, it will not happen in the next ten years.

The first three charts below (in white) zoom in on these developments in recent years, linear scale, at USD / GB. That way, it becomes a bit easier to examine current trends, without having to deal with the prices from 60 years ago which were twelve magnitudes higher. The following two charts use logarithmic USB / MB scale to visualize the full history, which makes the very consistent longterm trends clear.

Detailed analysis continues below the charts.

See here for the updated data and charts, and detailed information.

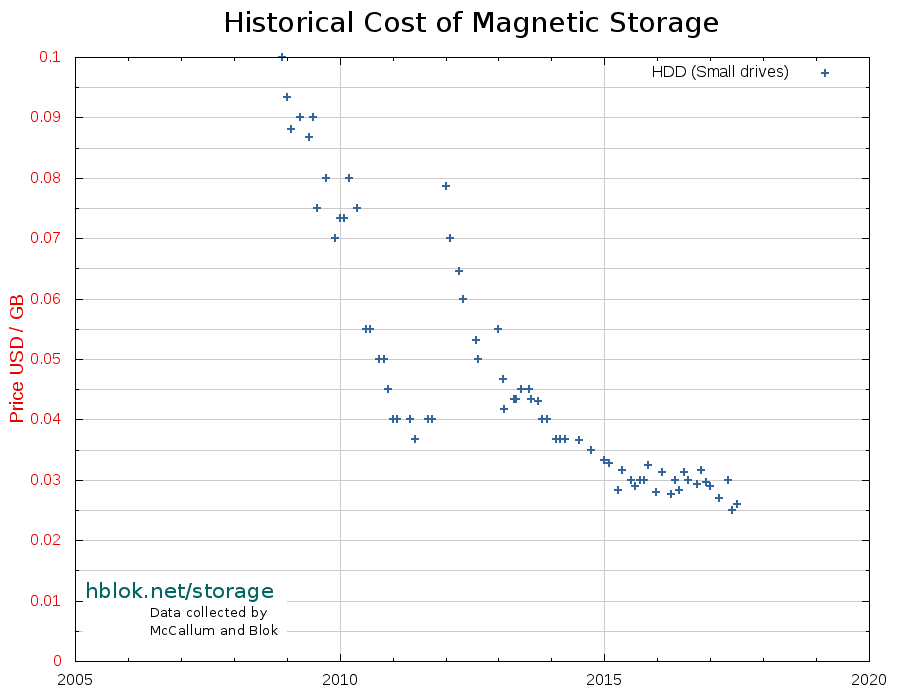

HDD: Recent history 2005 - present; Linear scale; USD / GB

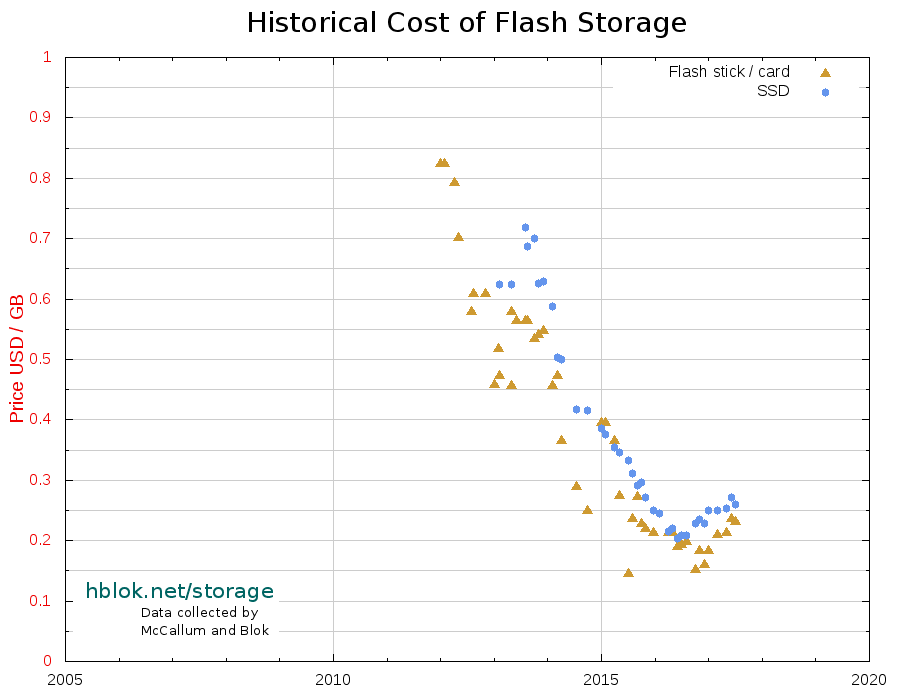

SSD: Recent history 2005 - present; Linear scale; USD / GB

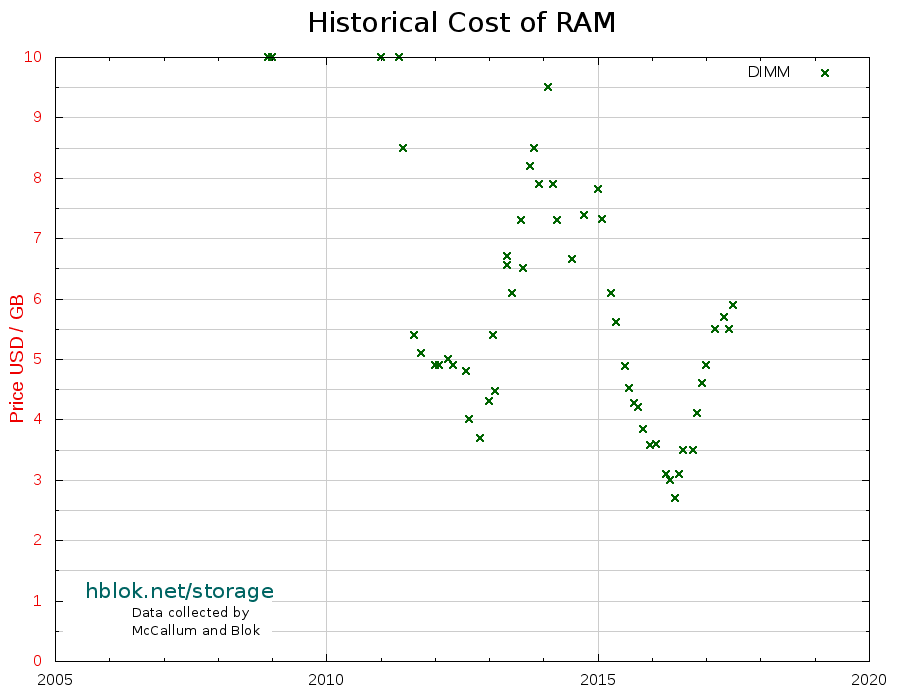

RAM: Recent history 2005 - present; Linear scale; USD / GB

Recent history 2005 - present; Logarithmic scale; USD / MB

Full history 1957 - present; Logarithmic scale; USD / MB

(Click image for larger version)

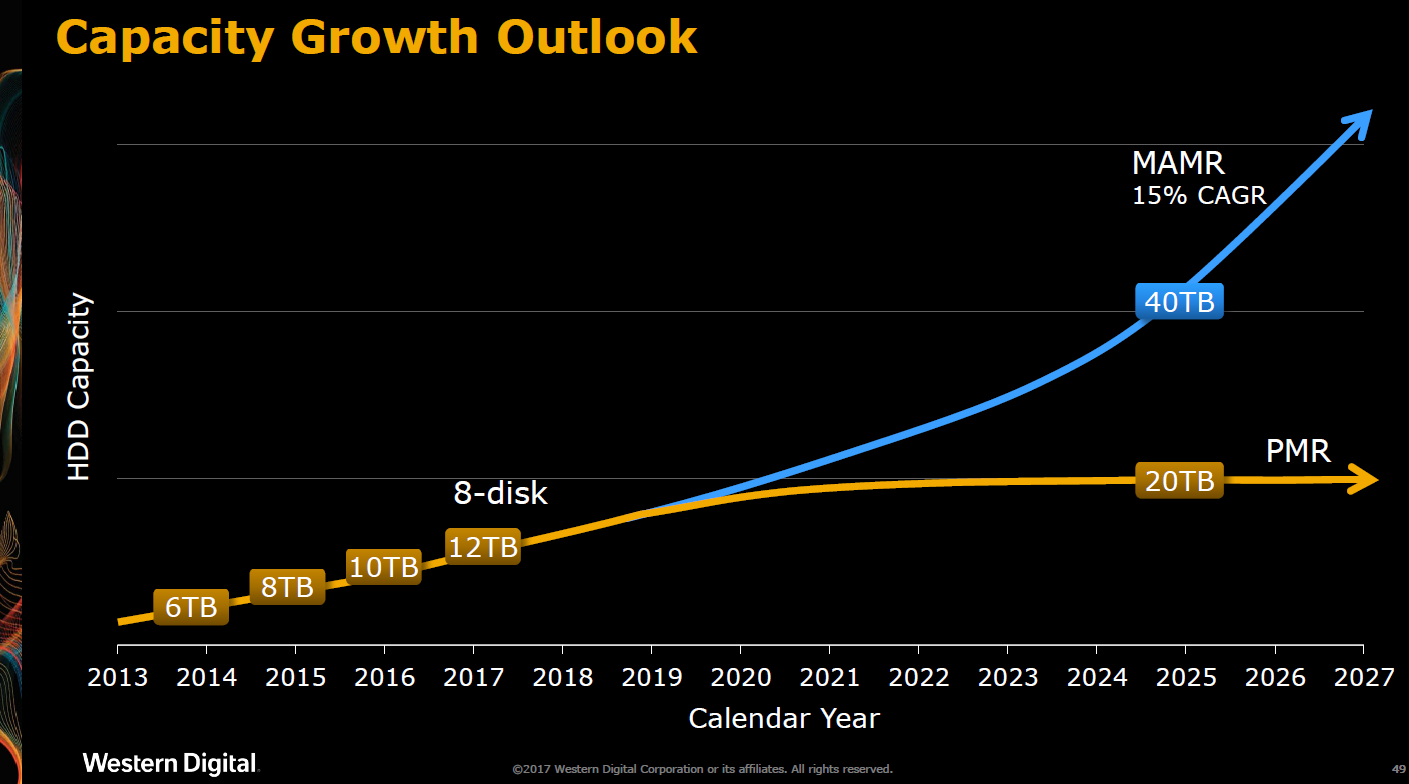

HDD

Despite sobering movements in price, there are interesting news on the horizon: Heat Assisted Magnetic Recording (HAMR) is now not too far away. Seagate talked about their plans for 2018 already at the beginning of this year, mentioning a 16 TB HAMR option. And this autumn, Western Digital demonstrated their first helium Microwave-Assisted Magnetic Recording (MAMR) drive. The principle of energized assistance in dealing with smaller magnetized areas is the same as HAMR, but MAMR uses a microwave while HAMR uses a laser. Western Digital talked about MAMR technology enabling growth to 40 TB by 2025.

Meanwhile, Toshiba announced a 9 platter PMR drive at 14 TB. This is probably closer to market than MAMR technology, and should see shelves in 2018. Even though nine platters is a very impressive feat, that direction will eventually stagnate, and so will PMR. That's way WD's chart below shows PMR flattening out, while in their opinion, MAMR will produce a drive double the size by 2025. Most likely, this will be realized combining all these technologies: helium filled drives; nine platters and MAMR.

It's interesting to note that with these developments, WD believes the 10x margin from SSD will continue for at least another ten years. However, with the sizes of the HDD options now available, we might also be at a point where it has saturated the "average" consumer demand. Except for special interests like photo, video or hoarding, a 1 or 2 TB SSD is still plenty of space in a laptop, everything else is "in the cloud" anyway. Therefore, the demand for large HDD will come from data centers and other corporate systems. They can afford higher prices, so the large drives might not see the same exponential decrease in price as the smaller consumer options.

SSD

The prices of SSDs still suffer from a supply shortage of NAND chips since autumn 2016. This has caused prices to increase during 2017. Furthermore, transition from 2D planer to 3D based technology has caused problems and delays for some manufacturers.

Future developments in SSD is now more focused on IO speed, and size, than reduction in price. Samsung’s massive 15 TB PM1633a became available last year, but at $10.000, that's for special interest only. Micron is following, and recently announced a 11 TB NVMe based drive, and interestingly designing its own rack solution for SSDs in "shared storage" configuration for the data centre.

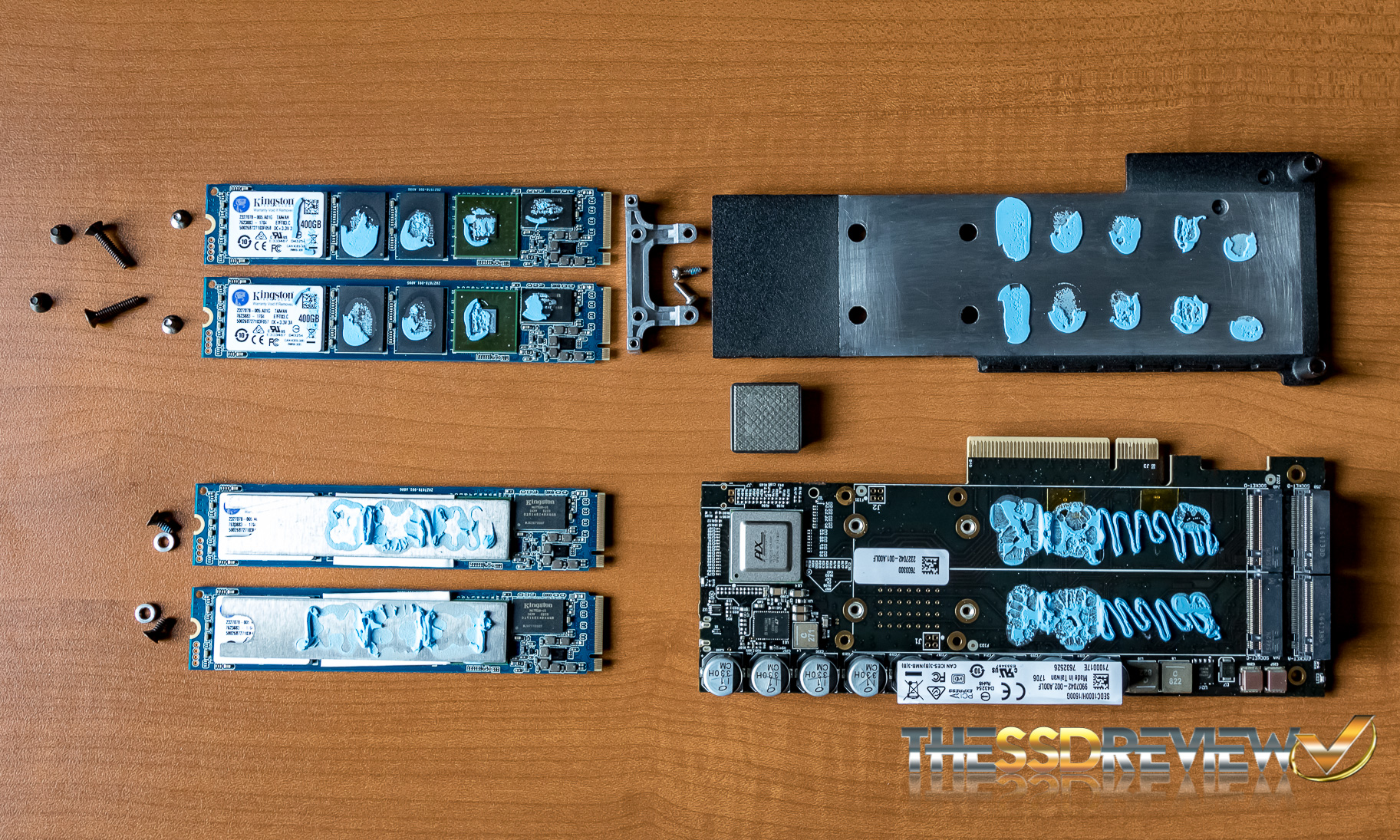

Even for the home user, it looks like SATA based SSD storage will soon be over, with newer solutions connecting to the PCIe bus over NVMe using the M.2 or U.2 connectors, or directly through PCIe HHHL (half-height half-length) cards. This gives extreme bandwidth potential, and Kingston's DCP1000 1.6TB has reached 7 GB/s (in RAID configuration). It's amusing to see that the PCIe the card merely a container for four M.2 drives.

It seems SATA will be left behind in the SSD market, as most high-end products now connect to the faster PCIe bus, either over M.2 or U.2 connectors, or directly with a HHHL (half-length half-height) PCIe slot card.

RAM

Finally, memory prices have also been increasing over the last year, again due to supply shortage. Some blame Apple's latest iPhone, and expect the supply shortage to last into 2018, when "Samsung and SK Hynix [are] expected to begin production at additional factories".

Technology wise, DDR4 is now well established, and Corsair just released a 32 GB kit at 4 GHz, while G.Skill announced a 16 GB 4.6 GHz kit. Meanwhile, Rambus is planning the next generation: DDR5 and HBM3 (High Bandwidth Memory for GPUs). They plan to move to a 7 nm process (down from 28 nm in DDR4), and expect 4.8 - 6.4 Gb/s bandwidth. However, products will not show up before 2019, the earliest.